georgia property tax relief for seniors

Property Tax Homestead Exemptions. In the 2022 tax year filed in 2023 the standard deduction is 12950 for Single Filers and Married Filing Separately 25900 for.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

The qualifying applicant receives a substantial reduction in property taxes.

. About the Company Georgia Property Tax Relief For Seniors. CuraDebt is a company that provides debt relief from Hollywood Florida. For those over the age of 65 Georgia does not tax Social Security benefits and gives a deduction of up to 65000 per.

Alabama exempts senior citizens over the age of 65 from paying a state portion of property taxes. Currently there are two basic. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for.

Heres how it works. A Guide to Claiming Fulton County Property Tax Exemptions for Seniors. Is Georgia a tax haven for seniors or a tax haven for businesses.

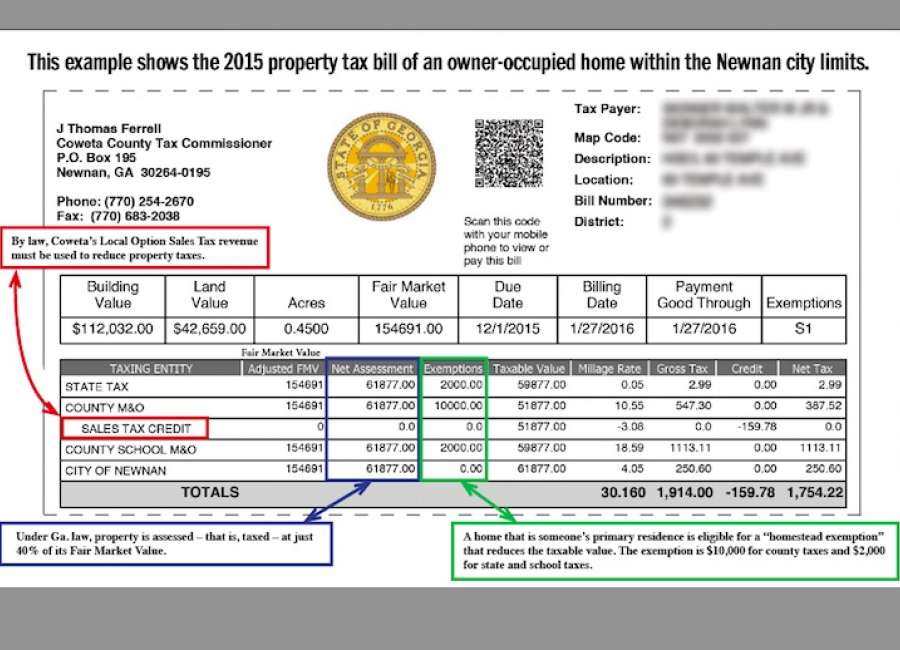

Property Taxes in Georgia. Any Georgia resident can be granted a 2000 exemption from county and school taxes. Del Webb Chateau Elan The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up.

New Yorks senior exemption is also pretty generous. Boasting a population of nearly 11 million Fulton County is Georgias most populous county. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

CuraDebt is a company that provides debt relief from Hollywood Florida. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Individuals 65 years or older may claim an exemption.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently. Further Georgia has an exclusion from state income tax that is directly targeted at seniors. Most senior homeowners regardless of their age are eligible for this.

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. 2022 Senior Citizen Standard Income Tax Deduction. County Property Tax Facts.

About the Company Georgia Seniors Relief Of School Tax. Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies. Does Georgia offer any income tax relief for retirees.

DeKalb County offers our Senior Citizens special property tax exemptions. In addition to lowering the assessed value of eligible properties a Senior Exemption reduces property tax liabilities. The exclusion allows a retiree who is 65 year or older to shield from state.

It was founded in 2000 and has been an active. People who are 65 or older can get a 4000 exemption. Property Tax Returns and Payment.

Non-military seniors in South Carolina can enjoy a. Our staff has a proven. Individuals 65 Years of Age and Older.

There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. It was founded in 2000 and has since become a. Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts.

Tax Relief For The Elderly But At What Cost Center For State And Local Finance

City Of Roswell Property Taxes Roswell Ga

Dekalb County Ga Property Tax Calculator Smartasset

Ninth District On Murphy Proposed Budget Taxpayers Financial Security Further Jeopardized Without Substantial Property Tax Relief Stafford Lbi Nj News Tapinto

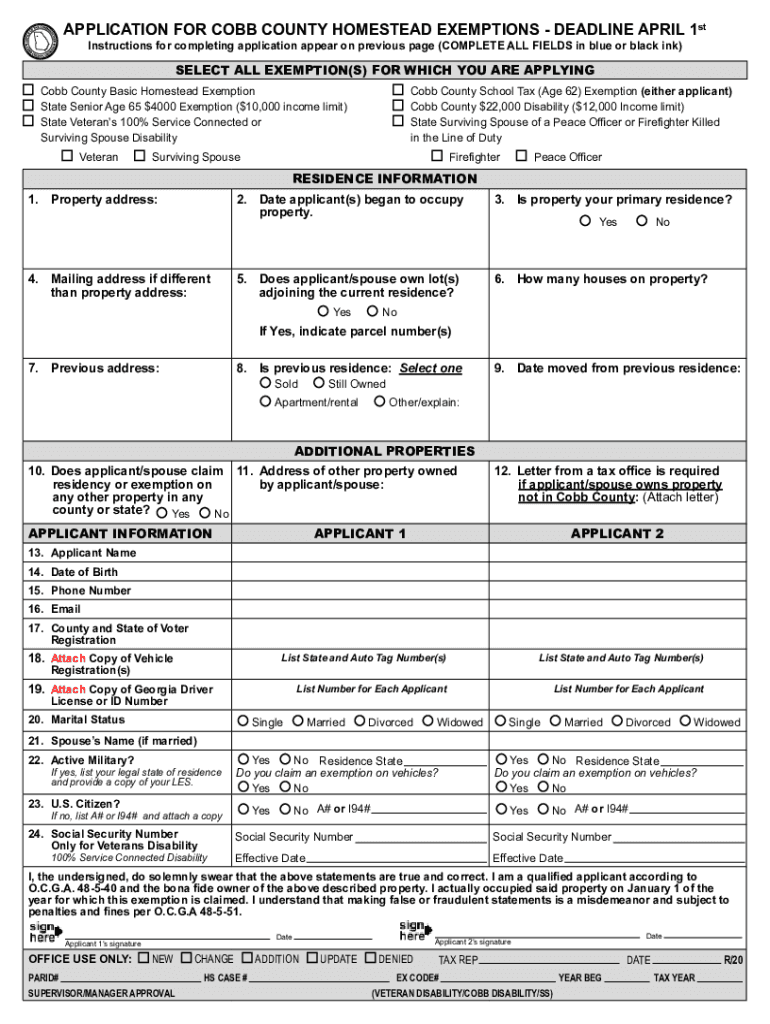

Ga Application For Cobb County Homestead Exemptions 2020 2022 Fill Out Tax Template Online Us Legal Forms

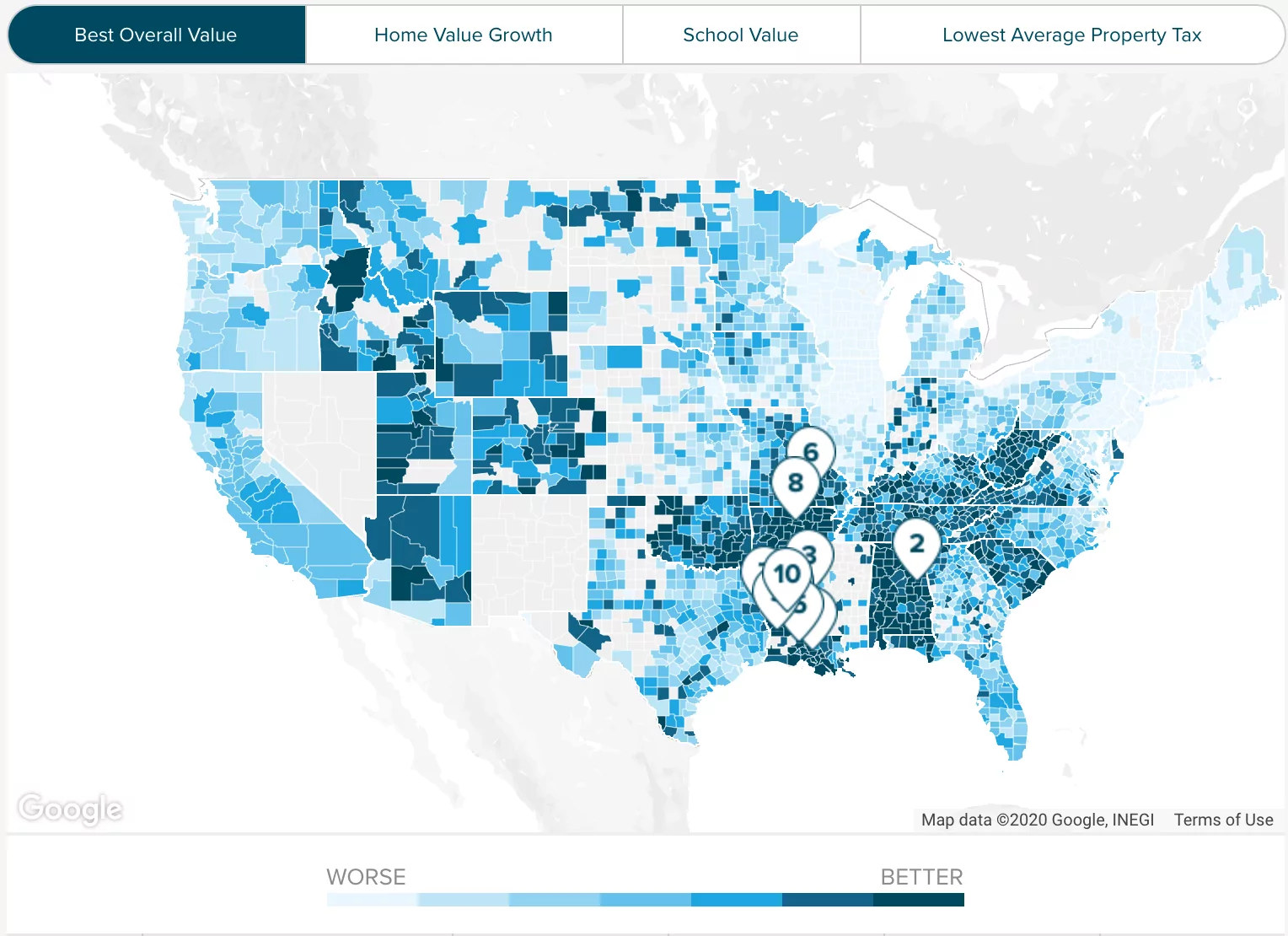

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/07-15-2022/t_c94ac012ea6c415c96ae7e0a566e3695_name_iStock_1139383323.jpg)

Georgia Tax Refund Still Haven T Seen Your Tax Rebate More Are Being Sent Out Soon Wsb Tv Channel 2 Atlanta

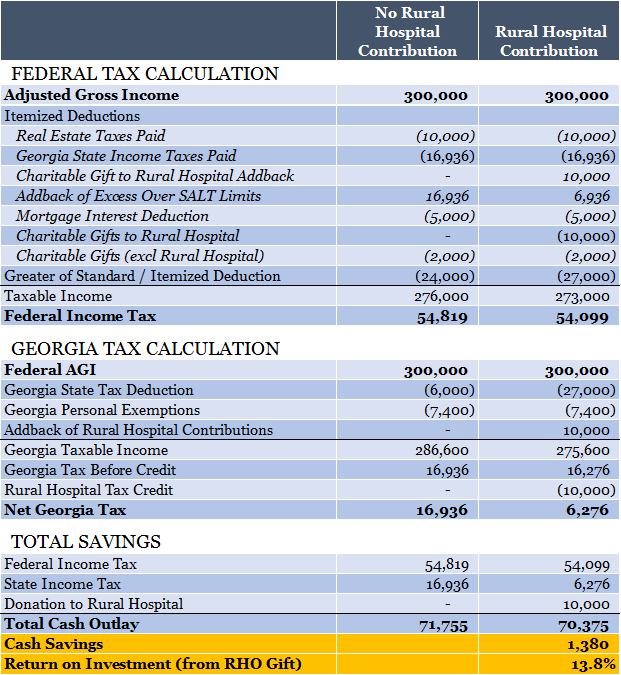

The Newly Expanded Tax Credit That Every Georgia Taxpayer Should Understand Resource Planning Group

Veteran Tax Exemptions By State

2019 Income Limit Set For Gwinnett Senior Property Tax Exemption

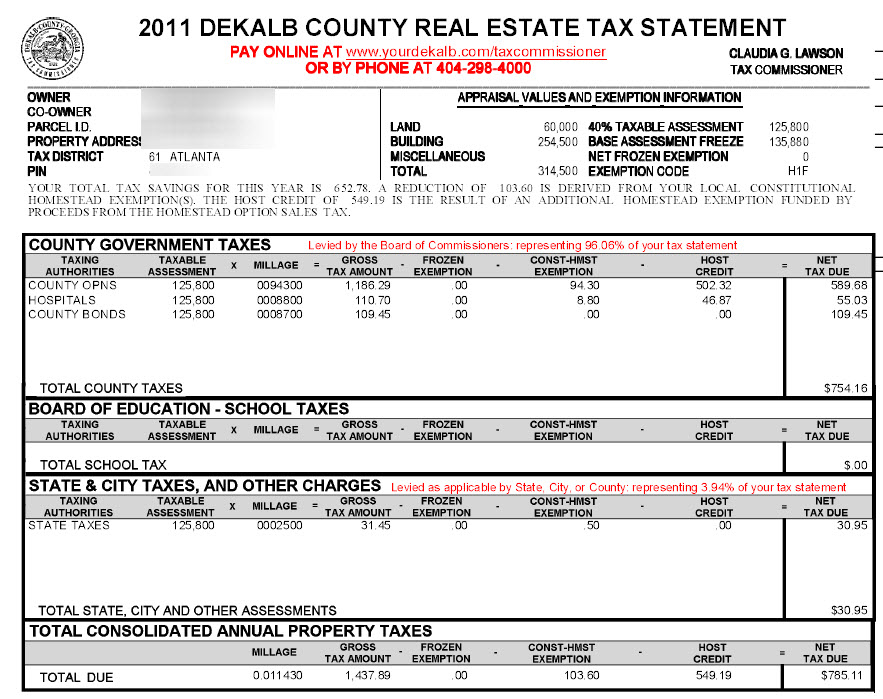

Dekalb County Property Tax Reduction Homestead Exemptions

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Are There Any States With No Property Tax In 2022 Free Investor Guide

Georgia Department Of Revenue Towards A Better Understanding Of Property Taxes Vicki Lambert September 11 Ppt Download